No products in the cart.

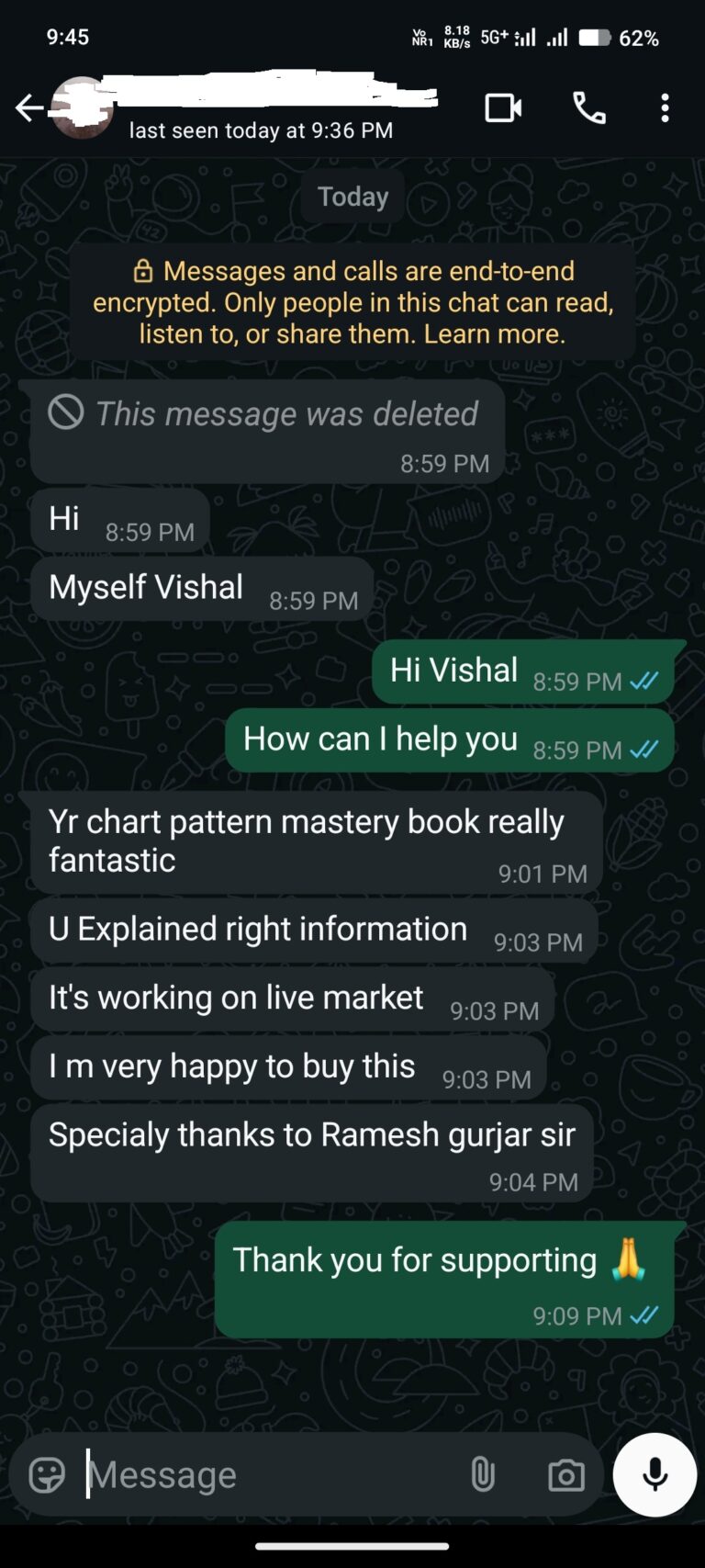

Chart Pattern Mastery : A Pro Trader Book

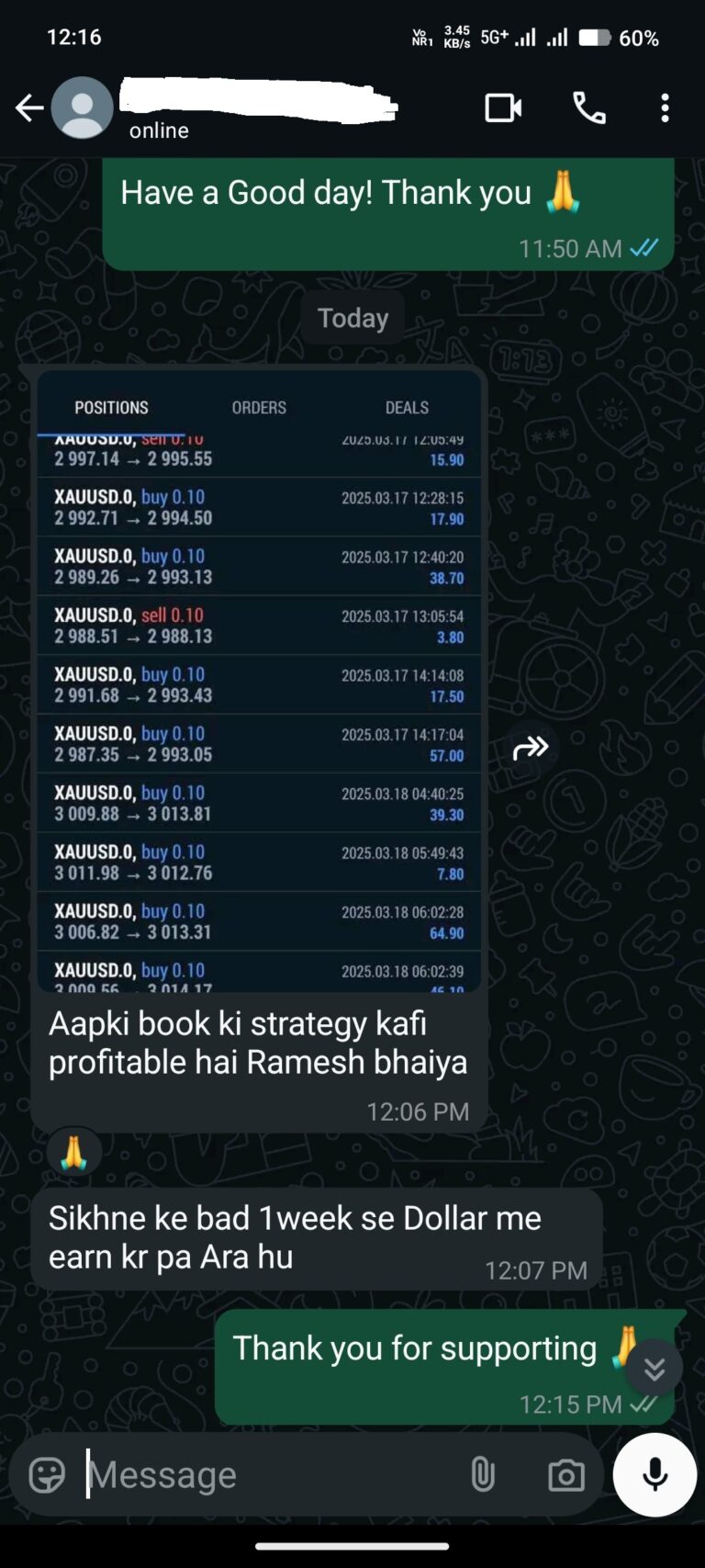

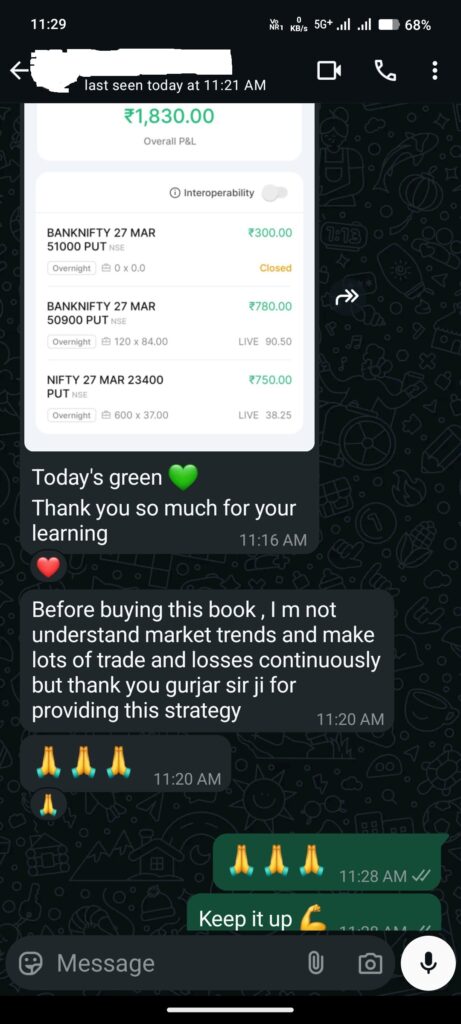

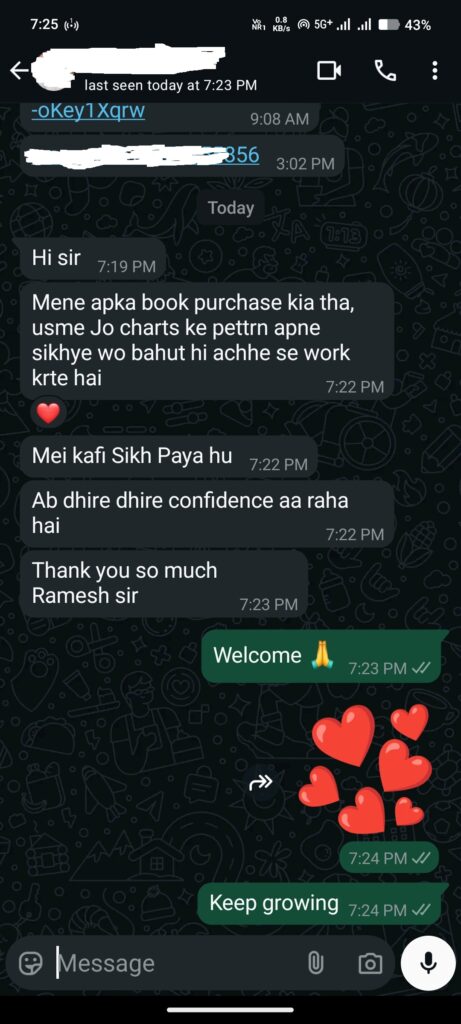

"Stop Guessing, Start Winning: Chart Patterns That Actually Work"

Hindi and English Edition - 2025

"Master the Patterns That Move Markets – Start Trading Smarter Today!"

50% SALE ENDING IN

Why This Book is a Game-Changer for Traders

- Simple explanations beginners + advanced tips for pros

- Clear visuals to spot trends FAST—no confusing jargon!

- Save Time & Money: Learn actionable steps that simplify complex patterns into clear strategies.

- Struggling with trading decisions? Learn to decode the markets with ease!

This Trading Chart Pattern eBook is your shortcut to spotting opportunities like seasoned traders. Inside, you’ll get : 52+ most profitable chart patterns (with real-market examples) for You.

Useful for all Stock market segment like…

- Intraday trading...

- Future Market...

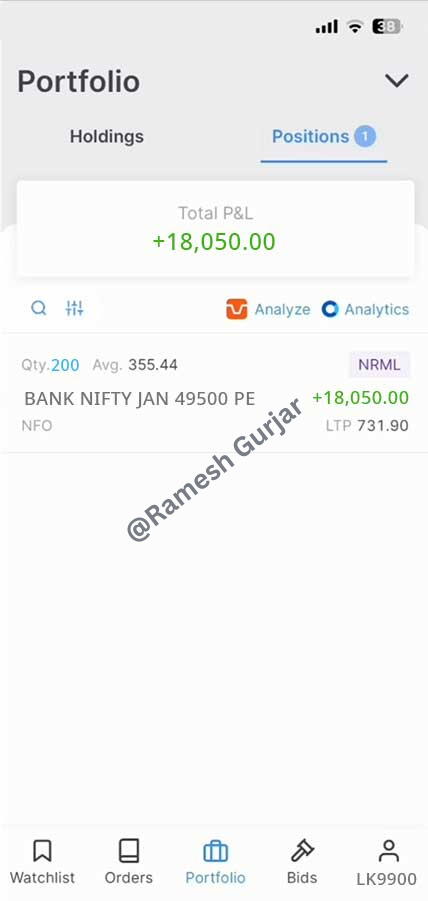

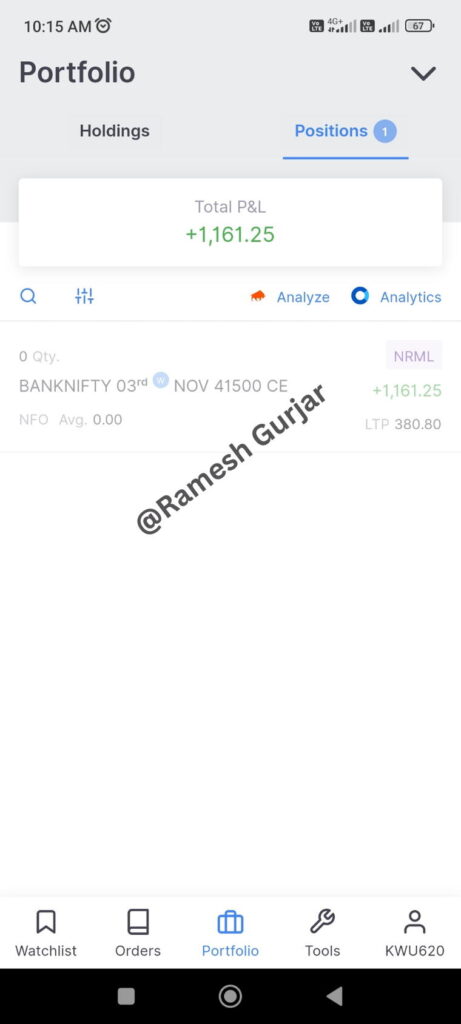

- Option trading...

- Currency trading...

- Commodity market...

- Forex trading etc...

Stop missing out on trades. Whether you’re day trading, swing trading, or investing long-term, this guide helps you act with confidence.

You always have a choice in life

Continue to struggle and wasting Time & Money in creating own for winning strategy.....

OR

Grab this Chart Patterns Mastery Book and Learn to decode the markets with our winning strategy ease!

Got more Questions? We have got you covered.

- What I Will Get After Purchase?

- "After payment, you'll be redirected to download instantly. Also, PDFs with download links will be sent to your email."

- Contact Us!

- Email : admin@thedigitalsender.com

- Whatsapp Support : +91 63591 55856

🔥 Limited Time Offer! ₹229/-